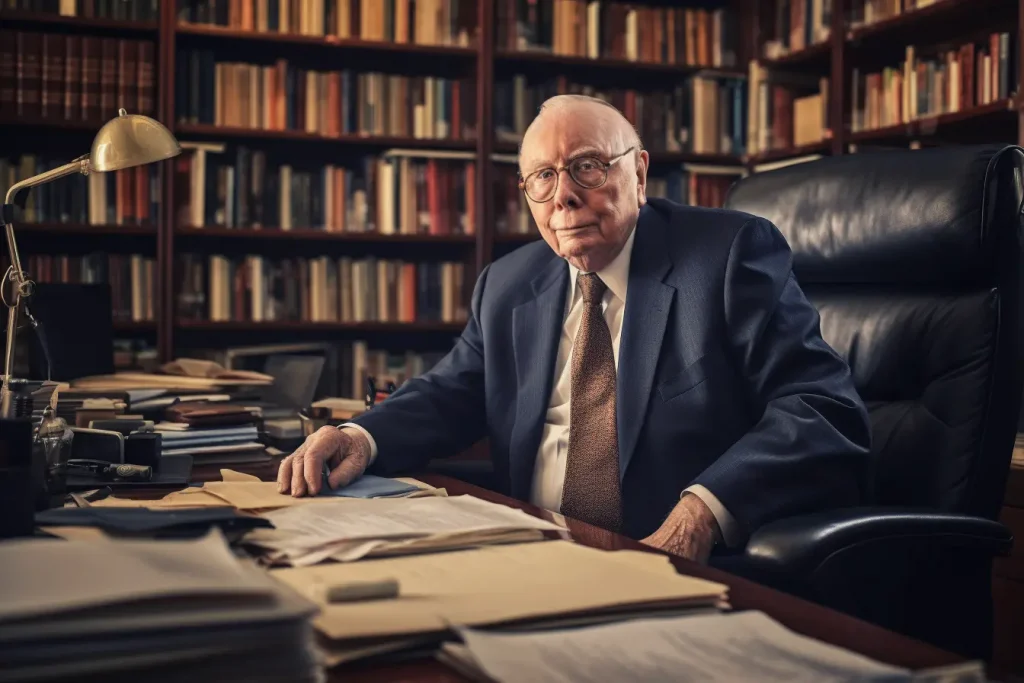

Charlie Munger was one of the greatest long-term investors in modern history. His philosophy centered on patience, deep understanding, rational thinking, and a refusal to chase market fads. His investments weren’t driven by trends or technical signals but by clear business logic and the power of compounding over time.

But here’s the challenge: most investors do not have the time or resources to analyze hundreds of companies in depth, read financial statements, build valuation models, or maintain a database of metrics. Even those who try often find themselves lost in complexity or overwhelmed by market noise.

Fortunately, recent advances in artificial intelligence in finance are making it possible to apply Munger’s long-term mindset without doing all the heavy lifting manually. With the help of AI investing tools like Sagehood, you can invest the way Munger would—but with real-time clarity, risk control, and deep analysis on demand.

This article explores how to think like Charlie Munger while letting Sagehood AI agents handle the technical, valuation, and signal-processing work for you.

1. Charlie Munger’s Core Investment Philosophy

To follow Munger’s strategy, it helps to understand his four core principles:

- Invest in great businesses with strong economics, not just cheap ones

- Wait patiently for the right opportunities instead of chasing momentum

- Avoid complexity and always choose clarity and simplicity

- Think independently, without letting noise or market sentiment interfere

Munger was a firm believer in buying high-quality companies with wide moats, strong cash flows, and predictable long-term growth. He avoided speculation, overtrading, and emotional decision-making.

This approach worked brilliantly for decades. But it also required discipline, financial modeling skills, and hours of reading. That’s where AI-powered stock picks come into play.

2. The Rise of AI Stock Analysis and Its Munger-Like Potential

While Munger read company filings and held ideas for years before investing, today’s retail investors can access many of the same insights instantly using AI stock analysis platforms.

Sagehood is a leading example of this transformation. It is an AI investing platform that uses intelligent agents to analyze stocks across valuation, fundamentals, technicals, sentiment, and macro factors.

Using Sagehood, you can simply ask a question—such as:

- “Is this company fairly valued based on discounted cash flow?”

- “What is the historical free cash flow trend for this stock?”

- “How does this business compare to its industry peers?”

- “Are there signs of momentum fading or institutional buying increasing?”

The AI reads the market and delivers answers in real-time, based on actual data, not speculation.

3. Identifying Wonderful Companies Without Manual Research

Charlie Munger often said the best investment strategy is to “buy wonderful businesses at fair prices.” He wasn’t chasing volatility or trying to time markets. He was finding businesses with long-term staying power.

Sagehood’s AI agents allow you to do the same by identifying:

- High return on invested capital

- Steady or growing operating margins

- Durable free cash flow generation

- Clean balance sheets and low leverage

- Competitive advantages visible in the data

This goes far beyond stock screeners. Sagehood enables in-depth qualitative and quantitative analysis of a company’s fundamentals—automated and structured—so you can act with clarity.

It’s how modern investors apply Munger’s principle of quality over quantity using AI investing tools.

4. Valuation Discipline Without Building Models

Munger avoided paying inflated prices, no matter how exciting a business seemed. He insisted on a margin of safety and looked at long-term intrinsic value, not just what the stock was doing today.

With Sagehood, you don’t need to build complex financial models. You can rely on its agents to:

- Run Discounted Cash Flow (DCF) models using consensus data

- Analyze EV/EBITDA and P/E multiples relative to peers

- Simulate valuation sensitivity based on earnings growth and risk factors

- Surface fair value ranges with clear base, bear, and bull cases

This kind of real-time valuation modeling helps you avoid paying too much. It ensures you can follow Munger’s “buy it right and sit tight” mindset—backed by data, not emotions.

5. Filtering Out Market Noise and Hype

One of Munger’s greatest strengths was ignoring media noise, hype cycles, and short-term distractions. He didn’t follow what was trending on social media or what analysts were hyping this quarter.

Sagehood helps you do the same through intelligent sentiment tracking. Its agents scan:

- Retail investor sentiment across social platforms

- Analyst upgrades and downgrades

- Institutional flow and volume imbalances

- Divergences between price action and public emotion

If a stock is surging on hype but fundamentals are deteriorating, Sagehood can flag the disconnect. Likewise, if sentiment is overly negative while the business remains sound, the platform can help identify potential value opportunities.

This is a practical application of Munger’s idea that you should be “fearful when others are greedy, and greedy when others are fearful”—but applied at scale and speed through artificial intelligence.

6. Smart Entry and Exit Points for Long-Term Positions

Munger wasn’t a market timer, but he did believe in buying with a margin of safety. That included entering at reasonable valuations and avoiding emotional decision-making during drawdowns.

Sagehood uses technical signals to help with smart positioning:

- Moving average crossovers to detect trend shifts

- RSI and MACD to evaluate overbought/oversold levels

- Fibonacci retracement zones to identify potential support

- Bollinger Bands and volume profiles to validate momentum or reversals

Combined with the platform’s valuation and sentiment analysis, these tools allow long-term investors to enter or add to positions more strategically—even when market conditions are uncertain.

Rather than trading frequently, the goal is to act with confidence when signals and fundamentals align—just as Munger would.

7. Real-World Example: Johnson & Johnson ($JNJ)

Let’s walk through how Sagehood might analyze a company like Johnson & Johnson, a classic Munger-style stock.

Using Sagehood AI agents, you could ask:

- What is JNJ’s free cash flow history over the past 10 years?

- Is JNJ undervalued based on DCF and peer multiples?

- What are the key support and resistance levels on the chart?

- Are institutions accumulating or distributing shares?

- Has momentum peaked or is there room to run?

The platform might respond with a fair value range of $155–$165, a recent cup-and-handle breakout pattern, positive MACD signal, and stable volume—confirming the stock as a strong candidate for long-term accumulation.

This kind of multi-factor analysis is what enables you to act with Munger-like clarity—without hours of manual research.

8. Thinking Long-Term in a Real-Time World

Munger’s greatest strength was thinking long-term in a world obsessed with short-term results. That kind of thinking is rare—but incredibly powerful.

What platforms like Sagehood enable is a blend of timeless strategy and modern execution. The AI doesn’t just spit out trade signals. It helps you:

- Track your portfolio’s valuation vs. quality

- Monitor long-term earnings growth vs. sentiment shifts

- Set alerts for when high-quality companies hit buy zones

- Stay out of the weeds, and focus on the bigger picture

In essence, Sagehood enables long-term compounding, backed by real-time insights.

Final Thoughts: Compounding Meets Computation

Charlie Munger’s investing philosophy is more relevant than ever in a world flooded with noise, speculation, and volatility.

But you no longer need to be a full-time investor or seasoned analyst to apply his wisdom. With AI stock analysis, AI-powered stock picks, and the discipline of a platform like Sagehood, you can think like Munger—while letting modern technology handle the execution.

You get the best of both worlds:

- The timeless logic of long-term investing

- The precision and speed of artificial intelligence in finance

If you’re ready to build a portfolio of durable businesses, guided by real signals and protected by data, Sagehood gives you the tools to do it—without sacrificing simplicity or clarity.

Invest like Munger. Let Sagehood do the work.

Start now at www.sagehood.ai